Fixing and Flipping homes can come with big rewards if you are aware of some key factors that play into your profitability. We know that the first step to getting started is securing a loan that meets the needs of your project. Our team understands getting into the Fix and Flip game and how to help you be successful no matter the project size. Let’s talk about these key factors and explore some frequently asked questions around fix and flip loans in order to get you pointed in the right direction. As always, we are available to discuss your investment goals anytime! Contact us and we’ll be happy to help!

What Are Fix & Flip Loans?

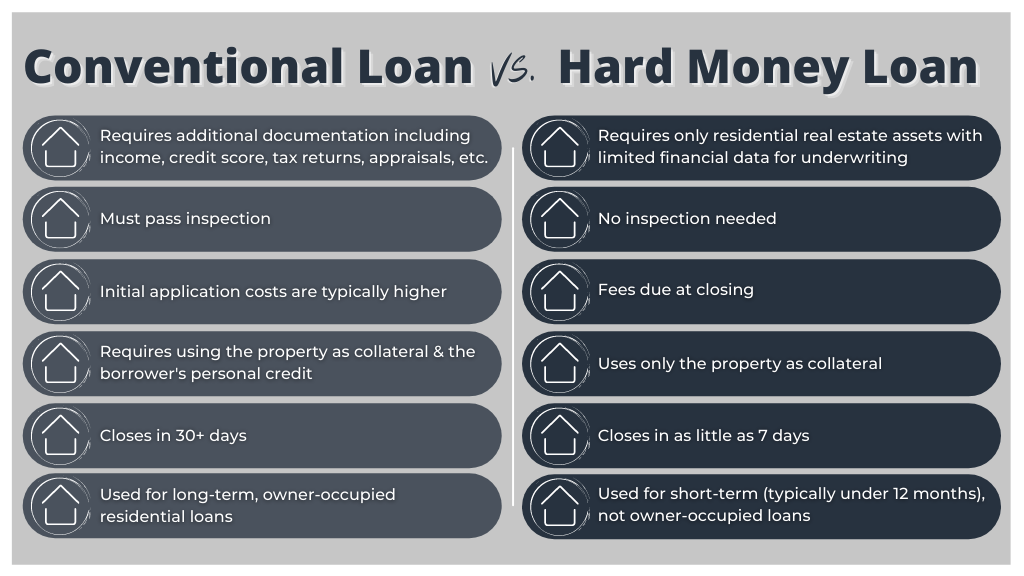

Fix and Flip loans are most often private money loans obtained by real estate investors in order to purchase a property, renovate it, and sell it for profit. This timeline is typically 6-12 months. Fix and Flip loans are most often acquired to purchase single family residential properties, townhomes, or condos at auction or are in foreclosure. Some investors may choose to use lines of credit or conventional loans to finance these projects, but there are many that choose a private money loan based on several beneficial differences.

Construction Loan or Fix & Flip Loan?

More Frequently Asked Questions

Yes, we are a direct lender, which simply means that the money we fund our loans with is our own and is readily available. Some lenders have to raise money to fund their loans or have to go out and find a direct lender to fund their loans because they don’t have the money to fund the loans themselves.

No, there is no prepayment penalty on our 12-month fix-and-flip loans.

Yes, we only lend to real estate companies. Our fix-and-flip loans are available to the following borrowers:

· LLCs

· Limited Partnerships, General Partnerships

· Corporations

No. Pineywoods provides commercial only loans that are non-owner occupied (investment) properties.

We look at things very differently than a bank and rely mostly on your real estate experience and other common sense factors when making decisions.

Pineywoods Capital will ask for the following documents for Fix and Flip Loans:

· Sales Contract

· Renovation Budget

· Two-months of recent bank statements

· A list of properties you currently own (an REO Schedule)

· Two years of tax returns

· LLC Operating Agreement or Articles of Organization

Unlike other private loan lenders, our rates don’t come with an asterisk. We are transparent in our underwriting and the entire process of securing your loan. We base all rates on the individual property and borrower. If you’d like to learn more about our current rates or need additional information, call us and we’ll discuss your needs.

The following property types are eligible for our fix and flip loans:

· Single Family Residence (SFR)

· 2-4 Unit Properties

· Condos / Townhouses

Fast, reliable funding opens new doors of opportunity and greater access to bargain properties. In an industry where “cash is king”, the savvy fix-and-flip investor will find that the cost of borrowed capital can be well worth the benefits. We pride ourselves in helping investors see beyond the loan and instead envision the ability to expand their portfolio through borrowing. This strategy often leads to additional opportunities to increase your return on investment.

Every loan is different and it’s our pleasure to assist you in closing your loan as quickly as possible based on your individual application. If you prefer to call us, we are available!

A private direct loan typically carries a higher interest rate than a conventional bank loan, but it also comes with benefits a bank loan doesn’t—like higher leverage, funding for renovations, easy qualifying and no red tape. An experienced flipper with a successful track record who needs cash in hand in under two weeks can offset the cost of a private direct loan with the enhanced ability to compete for bargain properties—as well as faster project turn-around times.

What’s The Next Step?

Once you’ve determined the property you are interested in purchasing, the next step is to apply for a fix and flip loan. We make the process simple by providing a quick and easy form on our website. This will allow us to review the property in question, research the property, and contact you to move forward with personal information. As a security factor, we do not ask for personal information on our website to protect our clients. Our goal is to help you find the right loan for whatever investment property you are interested in purchasing.