Pineywoods Capital has a history of providing the most well-rounded experience in residential private money loans. As investors ourselves, we’ve been able to fine-tune the process of lending in order to best serve our clients. This approach leads to a trusted relationship with each of our loan applicants as well as a seamless process for future investments.

What is Private Money Lending?

In real estate financing, residential private money lending is defined as a non-bankable loan on an investment single family home or duplex. These investment properties are not owner-occupied and are typically 1-4 units including townhomes, single-family units, and condos. Often, you may see these loans being referenced as fix and flip loans, bridge loans, “no doc”, or private loans. What it all boils down to is that all of the underwriting decisions are based on the borrowers hard assets.

Is a Short Term Loan Right For Me?

There are many reasons why a real estate investor may need a short term loan instead of traditional bank financing. Review the examples below to determine if this is the best route for you. Additionally, we are always here to help review your upcoming project to assess the investment and provide guidance on the right loan type for you. Contact us to discuss your options further.

Investors that need to capture equity from an owned investment property to free up cash for additional property purchases. Refinancing existing investment properties is one of the best ways to grow your existing portfolio.

Investors needing cash to finance an upcoming fix and flip or rehab project. Acquisition of new properties through a traditional lender (especially for a first time investor) can be complicated and delayed. Utilizing a short term loan through a private lender alleviates many of the hurdles.

Borrowers that need funds quickly on their investment property. A short term loan through a private lender can often be approved within days. This means your project stays on time and the opportunity for a return on your investment is realized sooner.

Real Estate Investors needing financing for 12 months or less. We understand real estate investing best and have experience in growing a portfolio. A key component of this is obtaining a short term loan that not only allows for shorter terms, but also has advantages like no prepayment penalties and interest only financing.

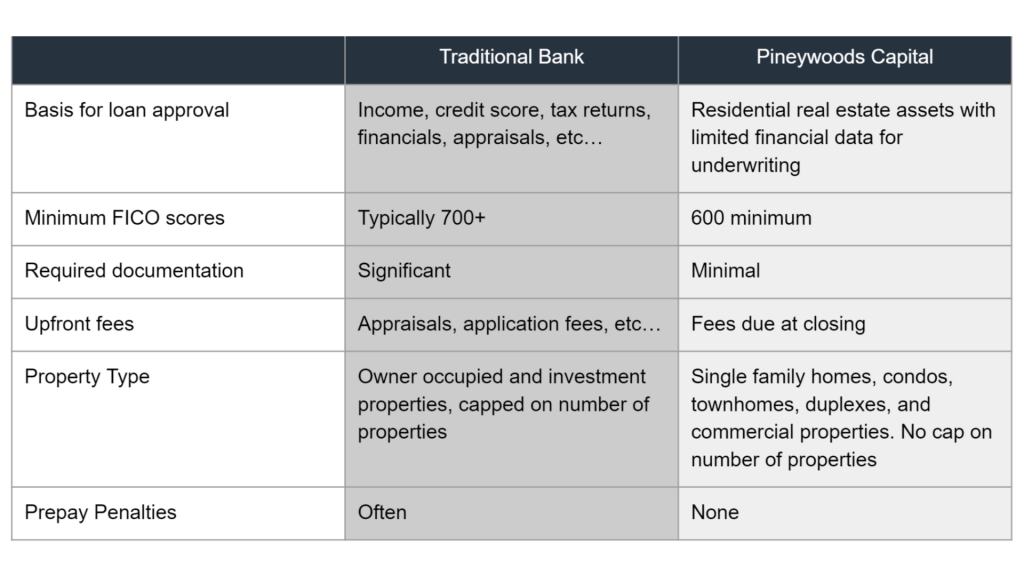

Why Choose a Private Lender?

There are many benefits to you, the real estate investor when choosing a private lender. Below are some of the major differences between lending through a traditional bank and Pineywoods Capital.

Ready to Get Started?

Beginning to invest in real estate is an exciting time. As well, growing your portfolio is a satisfying feeling. Our team is familiar with all of these experiences and understands the needs you have and questions you may not know to ask. It’s our pleasure to review any investment opportunity with you and provide sound advice towards achieving your goals.

Get started with Pineywoods Capital. Contact us today!